When starting a new job, one of the first things you will need to do is fill out a W-4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It is important to fill out this form accurately to ensure that you are not overpaying or underpaying your taxes throughout the year.

With the ever-changing tax laws and regulations, it can be overwhelming to keep up with the latest forms and requirements. That’s why having a printable version of the W-4 Form 2024 is essential. This allows you to easily access and fill out the form without having to worry about finding a physical copy or navigating through confusing online portals.

W-4 Form 2024 Printable

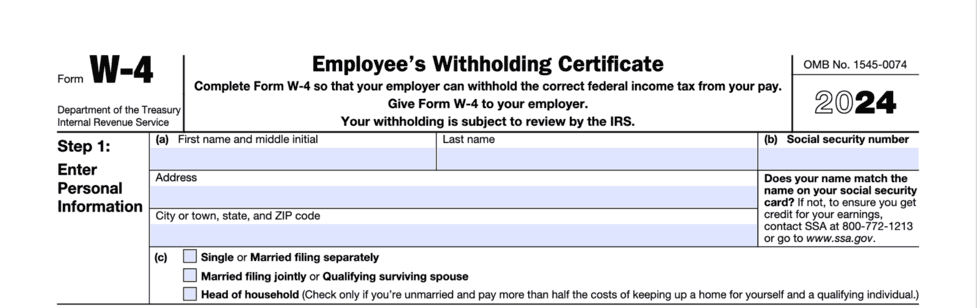

The W-4 Form 2024 is designed to be user-friendly and straightforward, making it easier for individuals to accurately report their tax information to their employer. By filling out this form correctly, you can ensure that the right amount of taxes are withheld from your paycheck, avoiding any potential surprises come tax season.

When completing the W-4 Form 2024, you will need to provide information such as your filing status, number of dependents, and any additional income you may have. By accurately reporting this information, you can avoid having too much or too little tax withheld, ultimately saving you time and money in the long run.

Having a printable version of the W-4 Form 2024 allows you to easily make any necessary updates throughout the year. If your financial situation changes, such as getting married or having a child, you can quickly fill out a new form and submit it to your employer. This ensures that your tax withholding accurately reflects your current circumstances.

In conclusion, the W-4 Form 2024 Printable is a valuable tool for individuals to ensure that their taxes are accurately withheld from their paychecks. By taking the time to fill out this form correctly, you can avoid any surprises or penalties when it comes time to file your taxes. Make sure to keep a copy of your completed form for your records and update it as needed to reflect any changes in your financial situation.