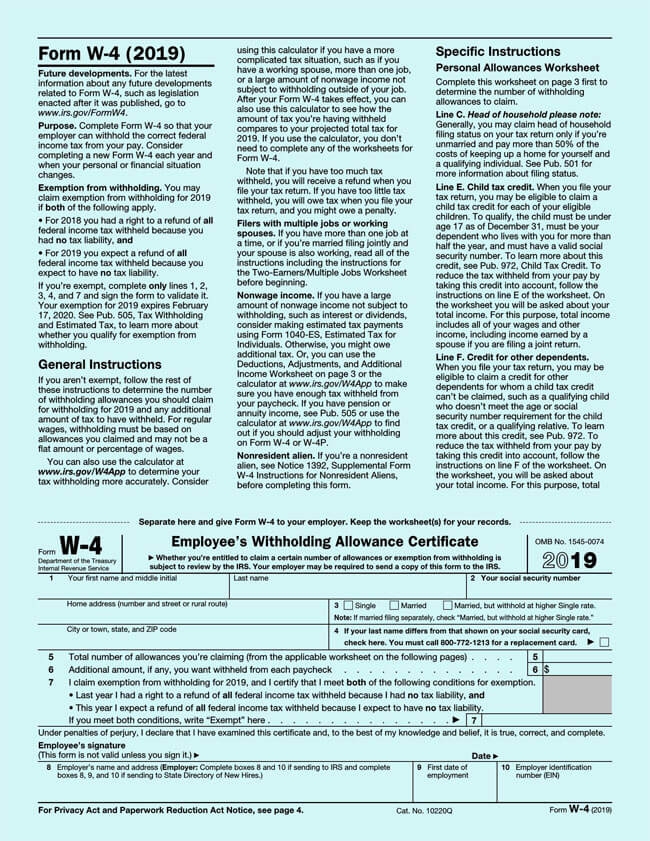

When it comes to taxes, one of the most important forms you will need to fill out is the W-4 form. This form is used by employers to determine how much federal income tax to withhold from an employee’s paycheck. It’s crucial to fill out this form accurately to avoid any issues with your taxes down the line.

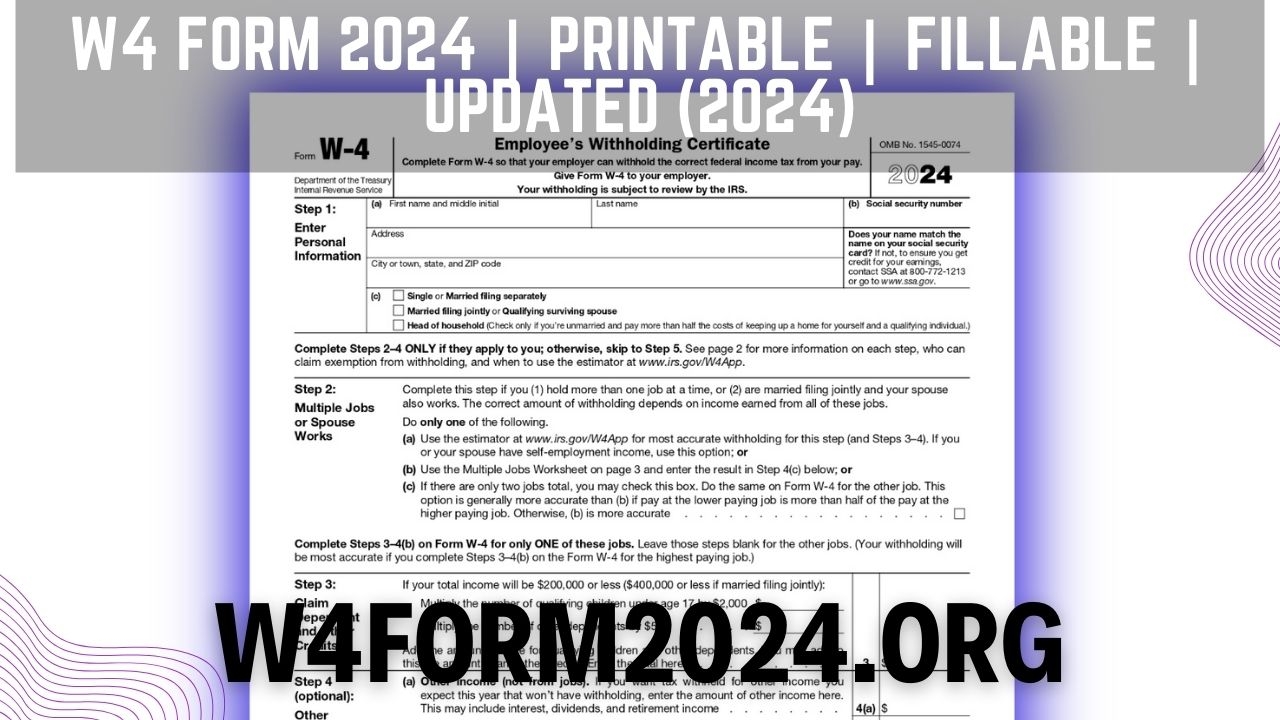

For the year 2024, the W-4 form has been updated with new guidelines and regulations. It’s essential to stay informed about these changes to ensure you are filling out the form correctly and complying with the latest tax laws.

When filling out the W-4 form for 2024, you will need to provide information such as your filing status, number of dependents, and any additional income you may have. This information will help your employer calculate the appropriate amount of federal income tax to withhold from your paycheck.

It’s crucial to review your W-4 form regularly, especially if there are any significant life changes such as getting married, having a child, or taking on a second job. These changes can impact the amount of tax you owe, so it’s essential to update your form accordingly.

Having a printable version of the W-4 form for 2024 can be helpful for those who prefer to fill out the form manually. You can easily find the form online, download it, and print it out to complete at your convenience. Just make sure to follow the instructions carefully and double-check your information before submitting it to your employer.

Overall, staying informed about the W-4 form for 2024 and filling it out accurately is essential for ensuring you are compliant with federal tax laws. By taking the time to understand the form and provide accurate information, you can avoid any potential issues with your taxes and ensure you are paying the correct amount of federal income tax.