When it comes to tax season, filling out the necessary forms can be a daunting task. One of the most important forms you’ll need to complete is the W 4 Form 2025. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s essential to fill out this form accurately to ensure you’re not under or overpaying your taxes.

With the W 4 Form 2025 Printable, you can easily access and fill out this form from the comfort of your own home. This printable version allows you to input all the necessary information, such as your filing status, number of dependents, and any additional income or deductions. Once completed, you can submit the form to your employer for processing.

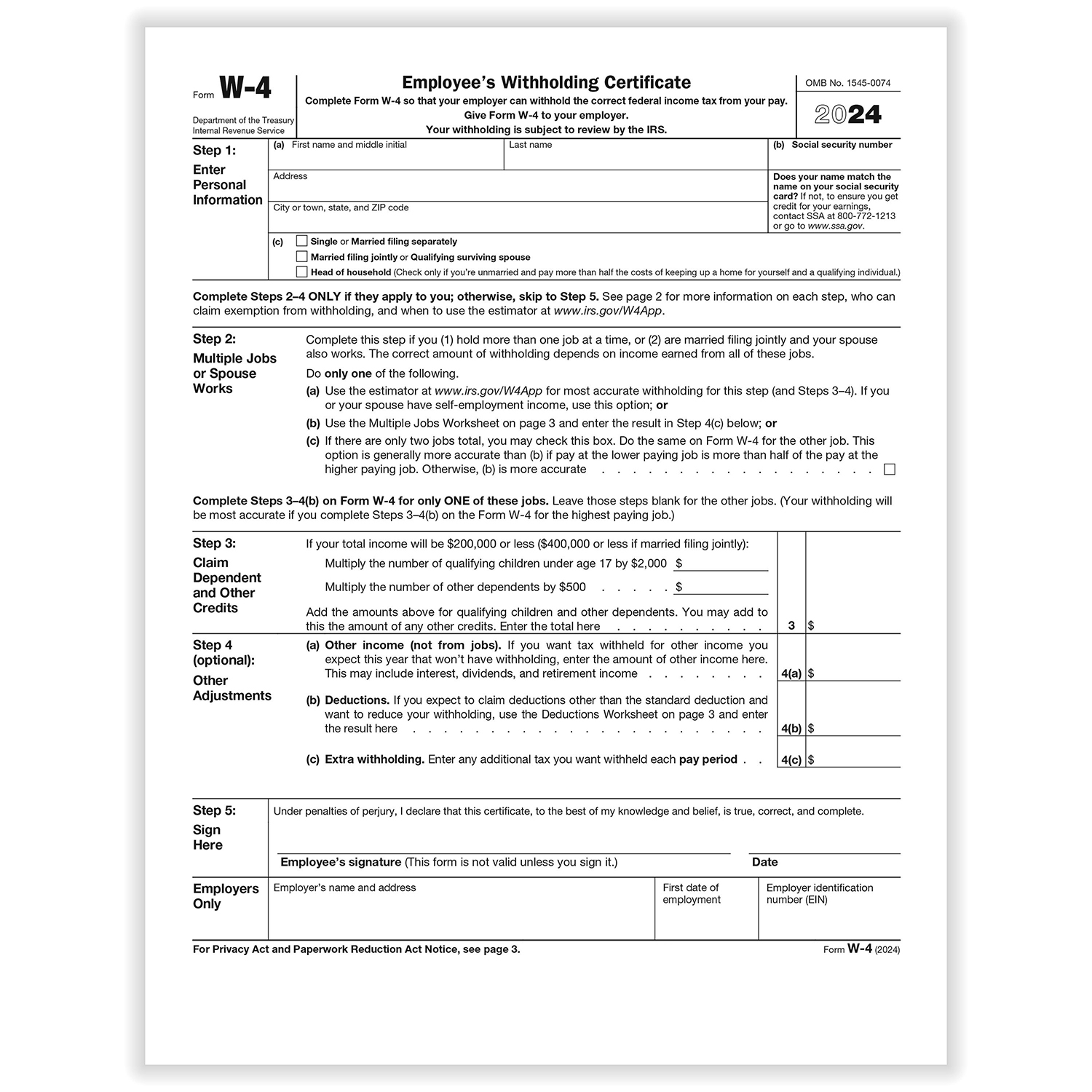

W 4 Form 2025 Printable

When filling out the W 4 Form 2025 Printable, it’s important to carefully review each section to ensure accuracy. Start by entering your personal information, including your name, address, and social security number. Next, indicate your filing status – whether you’re single, married filing jointly, or head of household.

One of the most crucial parts of the form is determining the number of allowances you’re claiming. This number impacts how much tax will be withheld from your paycheck. The more allowances you claim, the less tax will be withheld. If you’re unsure how many allowances to claim, you can use the IRS withholding calculator to help guide you.

Additionally, if you have any additional income or deductions that you want to be taken into account, make sure to include them on the form. This could include things like investment income, self-employment earnings, or deductible expenses. Providing accurate information will ensure that your tax withholding is as precise as possible.

Once you’ve completed the W 4 Form 2025 Printable, review it carefully to check for any errors or missing information. Once you’re confident that everything is correct, sign and date the form before submitting it to your employer. They will use this information to calculate the appropriate amount of federal income tax to withhold from your paychecks.

In conclusion, the W 4 Form 2025 Printable is a convenient tool to help you accurately report your tax withholding information to your employer. By carefully filling out this form and reviewing it for accuracy, you can ensure that you’re not paying more or less in taxes than necessary. Take the time to complete this form correctly to avoid any potential issues come tax season.