When it comes to tax documentation, the W-9 form is a crucial piece of paperwork that many individuals and businesses need to be familiar with. This form is used by employers to gather necessary information from their independent contractors or vendors for tax reporting purposes. It is essential for ensuring accurate reporting and compliance with tax laws.

Whether you are a freelancer, consultant, or business owner, understanding the purpose and importance of the W-9 form is essential. By providing the requested information on this form, you are helping to ensure that your income is reported accurately to the IRS and that you are compliant with tax regulations.

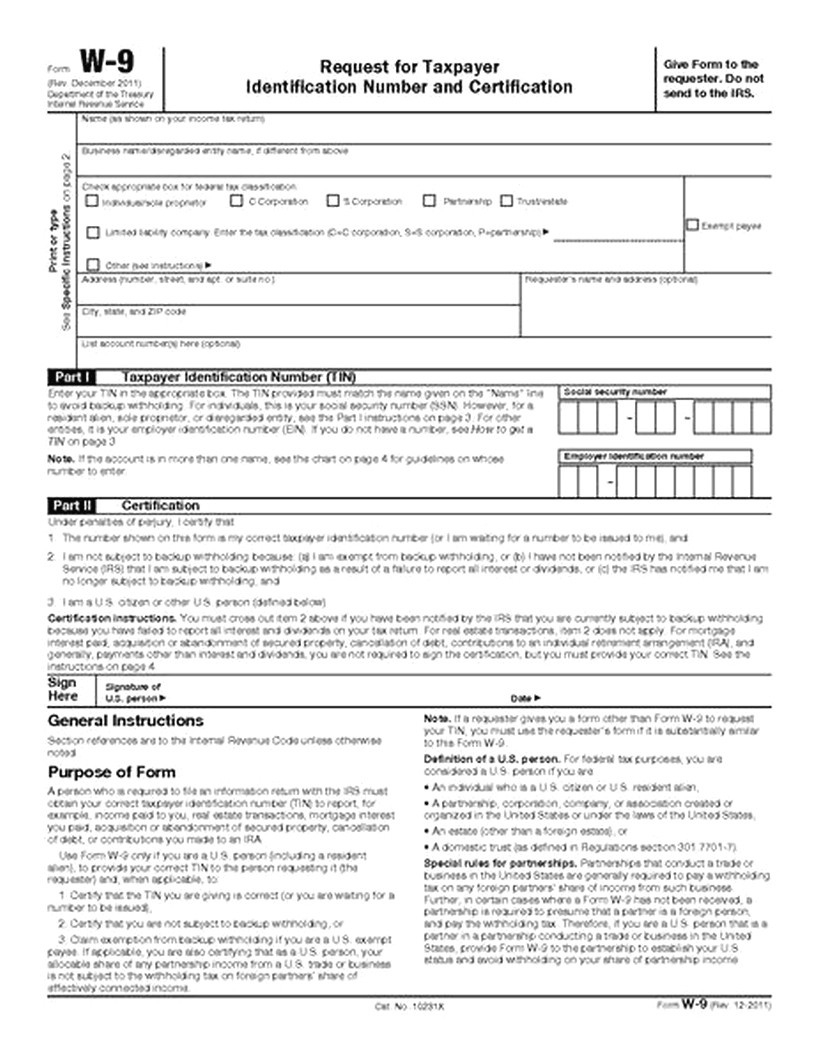

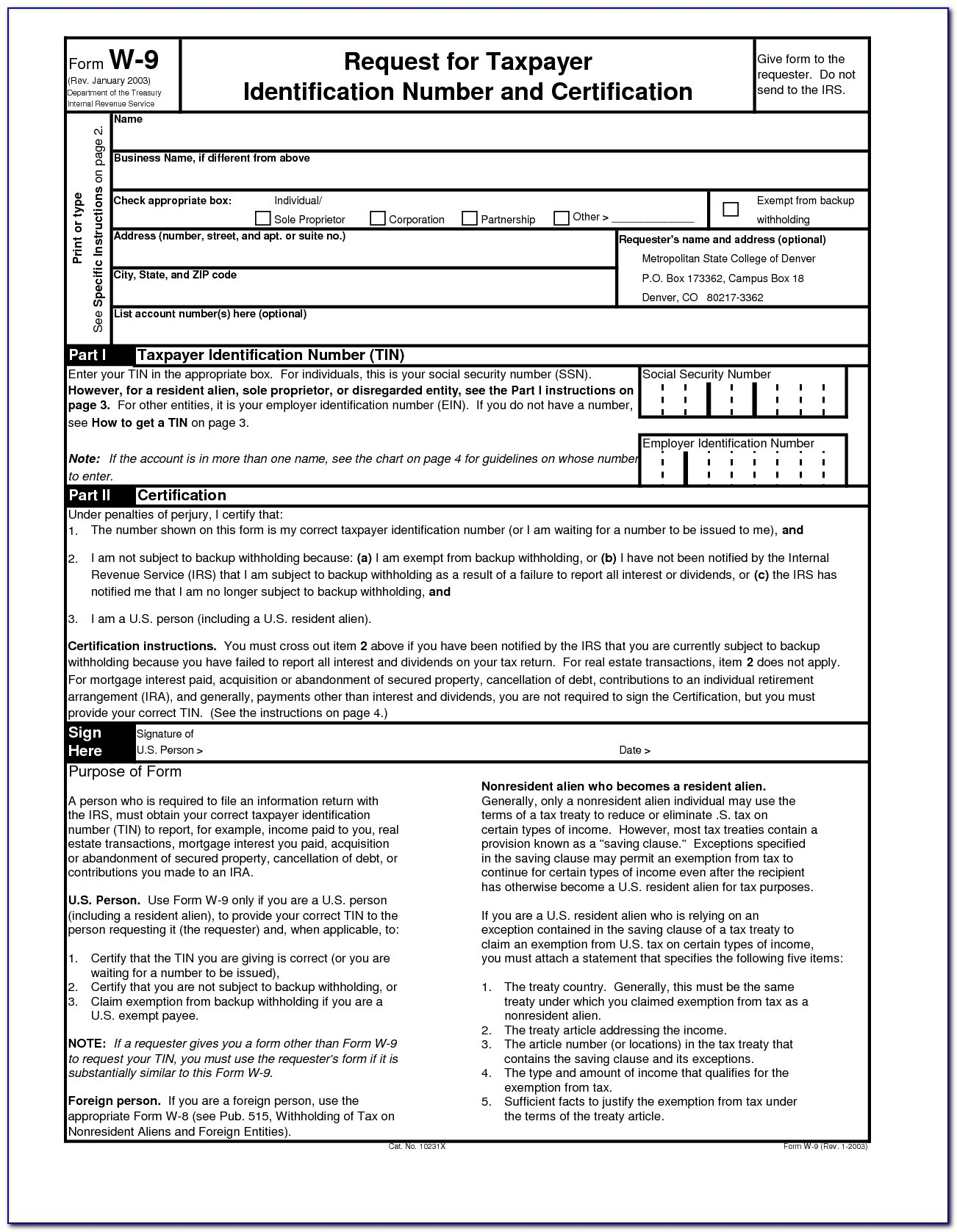

W 9 Printable Form

The W-9 form is a document that requests the taxpayer identification number (TIN) of an individual or business entity. It also collects other essential information such as the name, address, and entity type of the taxpayer. The form is used by businesses to report payments made to contractors, freelancers, and other non-employees to the IRS.

When filling out the W-9 form, it is crucial to provide accurate and up-to-date information to avoid any potential issues with tax reporting. Once completed, the form should be kept on file by the payer and used to generate Form 1099 for tax reporting purposes at the end of the year.

It is important to note that the W-9 form is not submitted to the IRS but is kept for internal record-keeping purposes. However, failure to provide a completed W-9 form when requested by a payer can result in backup withholding on payments made to you, which can have tax implications.

In conclusion, the W-9 printable form is a vital document for individuals and businesses involved in financial transactions that require reporting to the IRS. By understanding its purpose and ensuring accurate completion, you can help facilitate smooth tax reporting processes and maintain compliance with tax laws. Make sure to keep this form handy and provide it when requested by your payer to avoid any potential issues.