When it comes to tax-related documents, the W-9 form is a crucial piece of paperwork that is often required by businesses and organizations. This form is used to collect information from individuals, such as independent contractors or freelancers, who will be paid for their services. The information provided on the W-9 form is used by the Internal Revenue Service (IRS) to ensure that the individual receiving payment is properly reported and taxed.

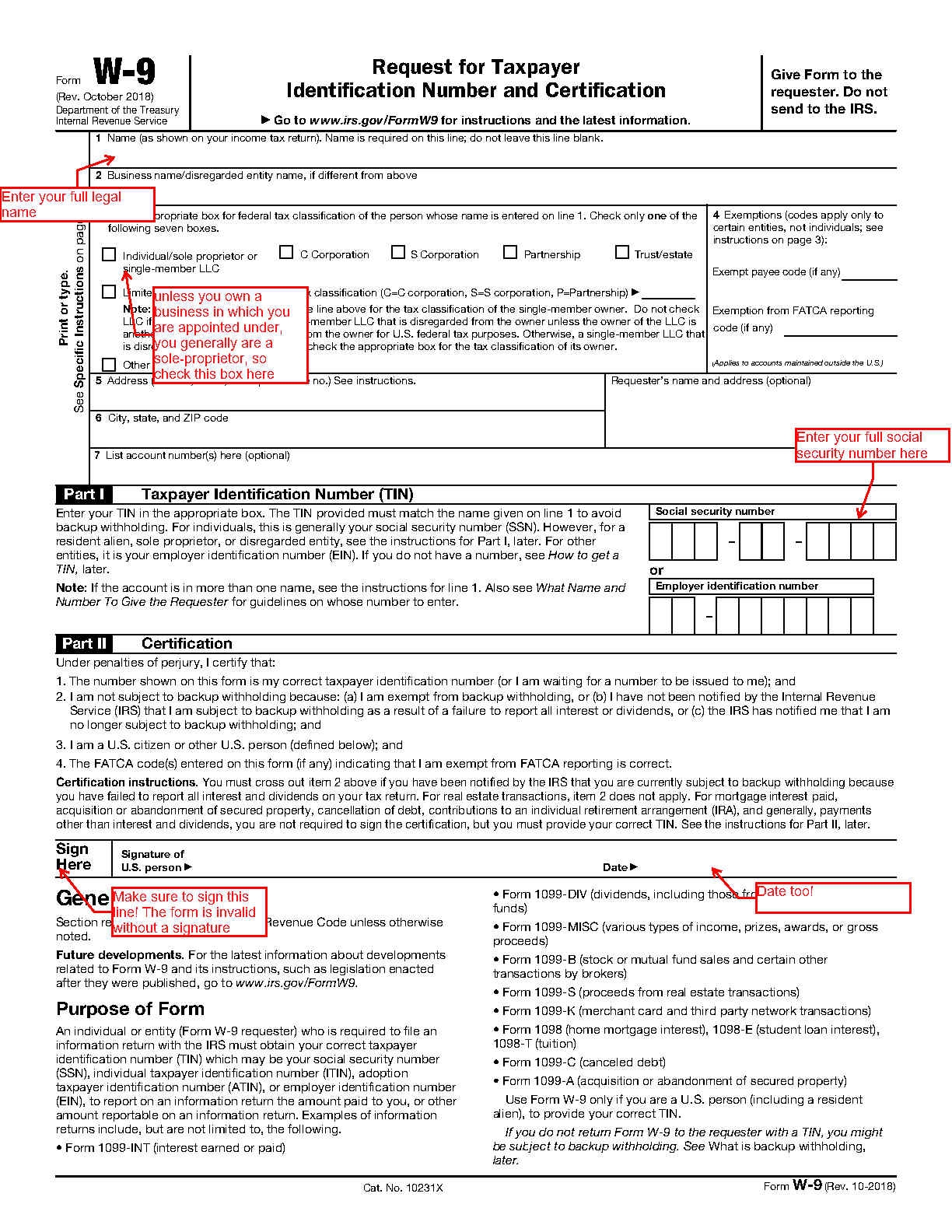

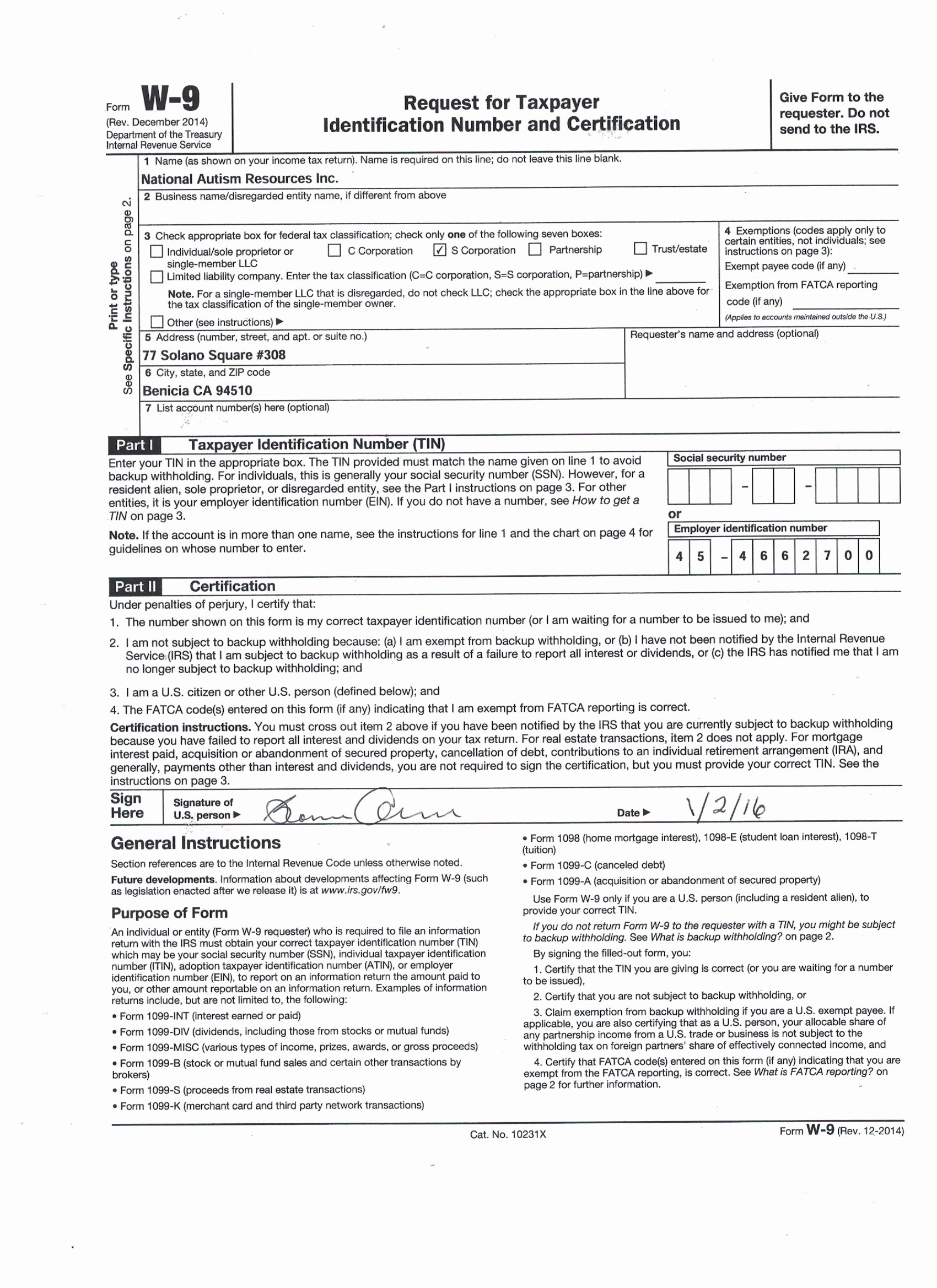

It is important for individuals to accurately complete the W-9 form to avoid any potential issues with the IRS. The form requires basic information such as the individual’s name, address, and taxpayer identification number (such as a Social Security number or employer identification number). Failure to provide this information can result in delays in payment or even penalties from the IRS.

When filling out the W-9 form, it is essential to carefully review the instructions provided by the IRS. The form must be signed and dated by the individual certifying that the information provided is correct. Once completed, the W-9 form can be submitted to the business or organization requesting it.

Businesses and organizations use the information from the W-9 form to report payments made to individuals to the IRS. This ensures that the IRS has accurate records of income earned by individuals and can enforce tax laws effectively. It is important for businesses to keep copies of W-9 forms on file for each individual they make payments to.

Overall, the W-9 form is a vital document for both individuals and businesses when it comes to tax compliance. By accurately completing and submitting the form, individuals can ensure that they are properly reported and taxed on their income. Likewise, businesses can use the information provided on the W-9 form to stay compliant with IRS regulations and avoid any potential penalties.

In conclusion, the W-9 printable form IRS is an essential tool for individuals and businesses to accurately report income and payments to the IRS. By understanding the importance of this form and following the instructions provided, individuals can ensure that they are compliant with tax laws and regulations.