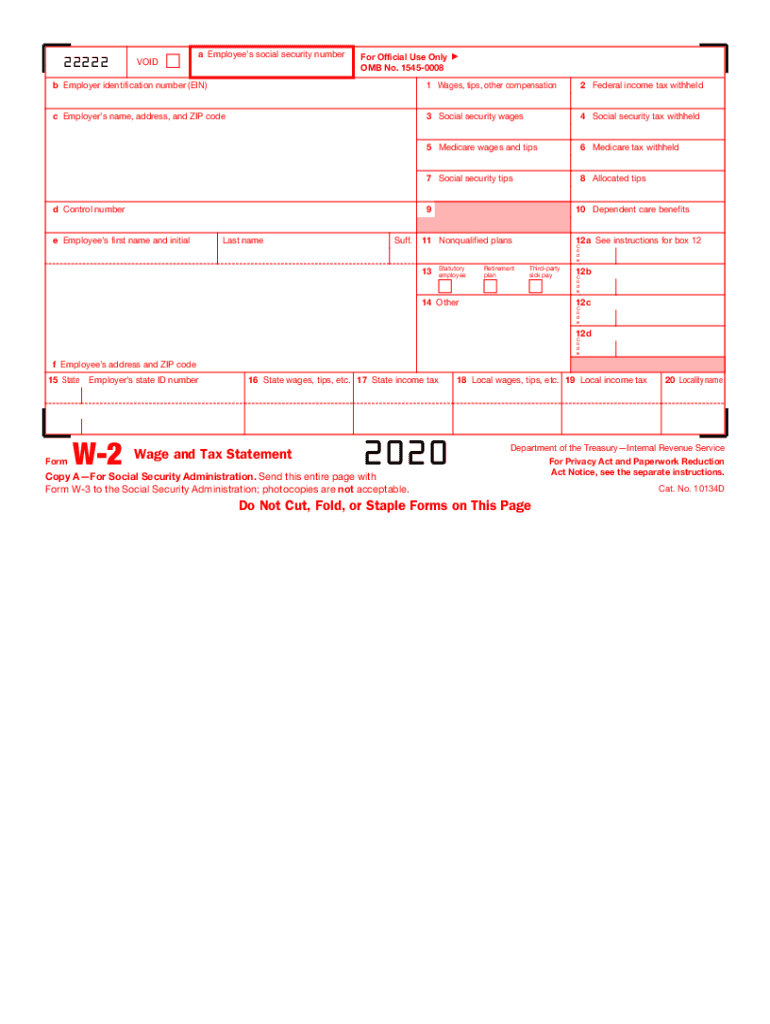

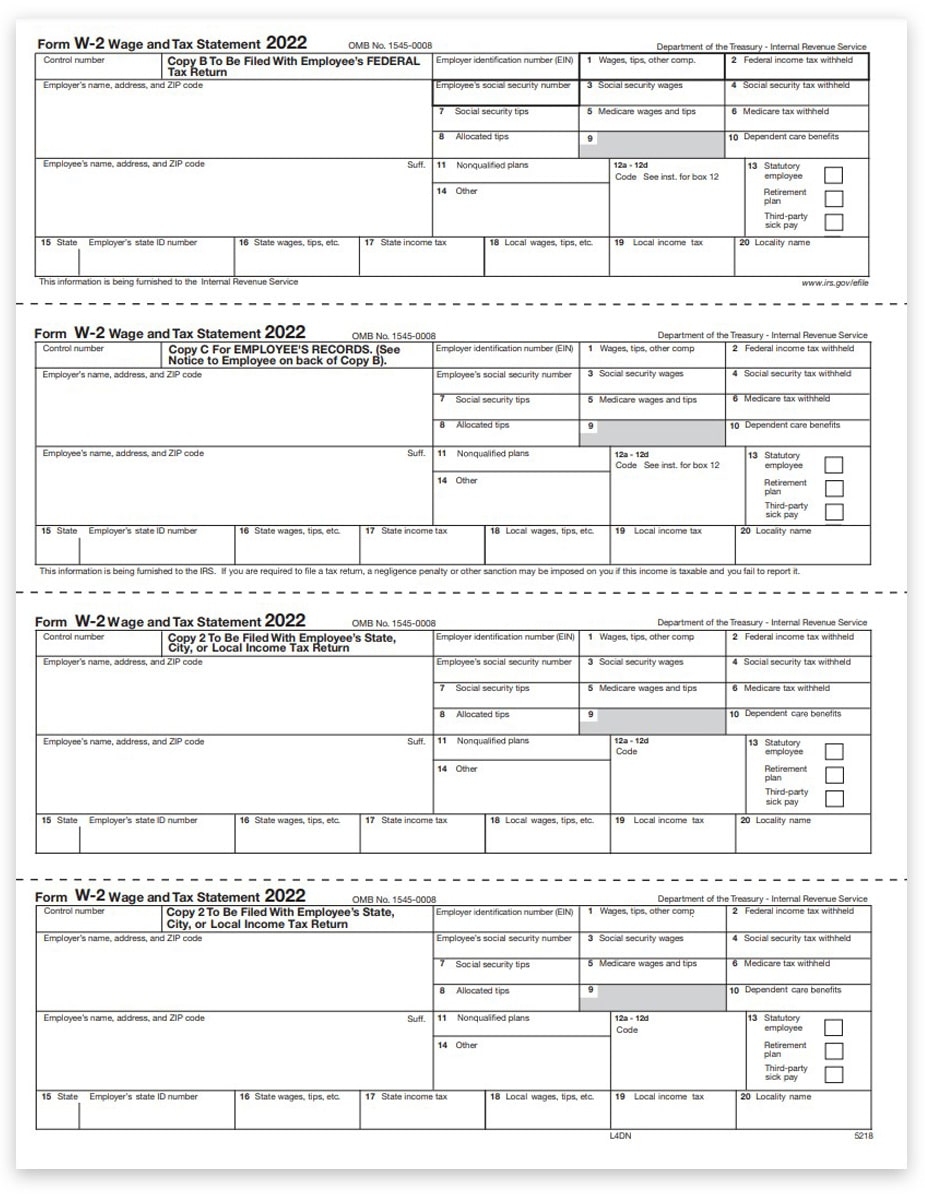

When tax season rolls around, one of the most important documents you’ll need is your W2 form. This form is essential for reporting your income and taxes paid to the IRS. Many employers provide their employees with a physical copy of the W2 form, but what if you need an extra copy or if you’ve misplaced yours? That’s where printable W2 forms come in handy.

Printable W2 forms are readily available online, making it easy for you to access and print out a copy whenever you need it. Whether you’re filing your taxes on your own or working with a tax professional, having a printable W2 form ensures that you have all the necessary information at your fingertips.

These printable forms typically include all the details found on a standard W2 form, such as your personal information, earnings, deductions, and taxes withheld. They are designed to be easy to read and fill out, making the tax filing process smoother and more efficient for you.

One of the benefits of using printable W2 forms is that they are customizable. You can input your information directly onto the form before printing it out, saving you time and effort. This feature also allows you to make corrections or updates as needed before submitting your taxes.

Additionally, printable W2 forms are a convenient option for those who prefer to file their taxes electronically. You can simply scan the completed form and upload it to your tax preparation software or email it to your accountant. This eliminates the need to mail physical copies and speeds up the filing process.

In conclusion, printable W2 forms are a valuable resource for individuals needing to access their tax information quickly and efficiently. Whether you’ve lost your original form or just need an extra copy, printable W2 forms offer a convenient solution. Make sure to take advantage of this online tool to streamline your tax filing process this season.