When it comes to tax season, there are various forms that individuals and businesses need to familiarize themselves with in order to stay compliant with the IRS. One such form is the W9 tax form, which is commonly used by businesses to request information from independent contractors or vendors they work with. Understanding the purpose and importance of the W9 form is crucial for both parties involved.

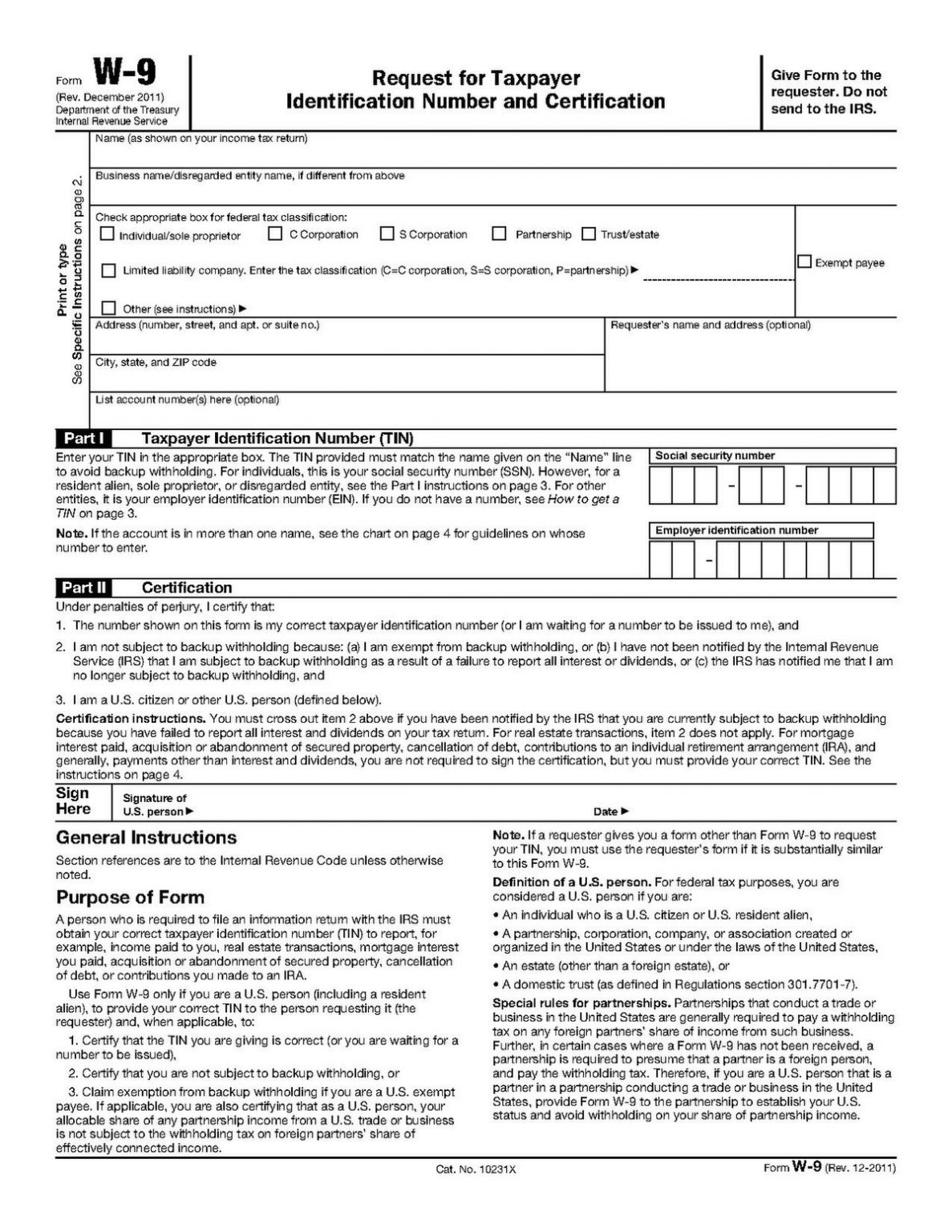

Essentially, the W9 form is used to collect important information from individuals or entities that are not considered employees, but are still paid for their services. This information includes the recipient’s name, address, and taxpayer identification number (TIN). By providing this information on the W9 form, the recipient certifies that the information is correct and that they are not subject to backup withholding.

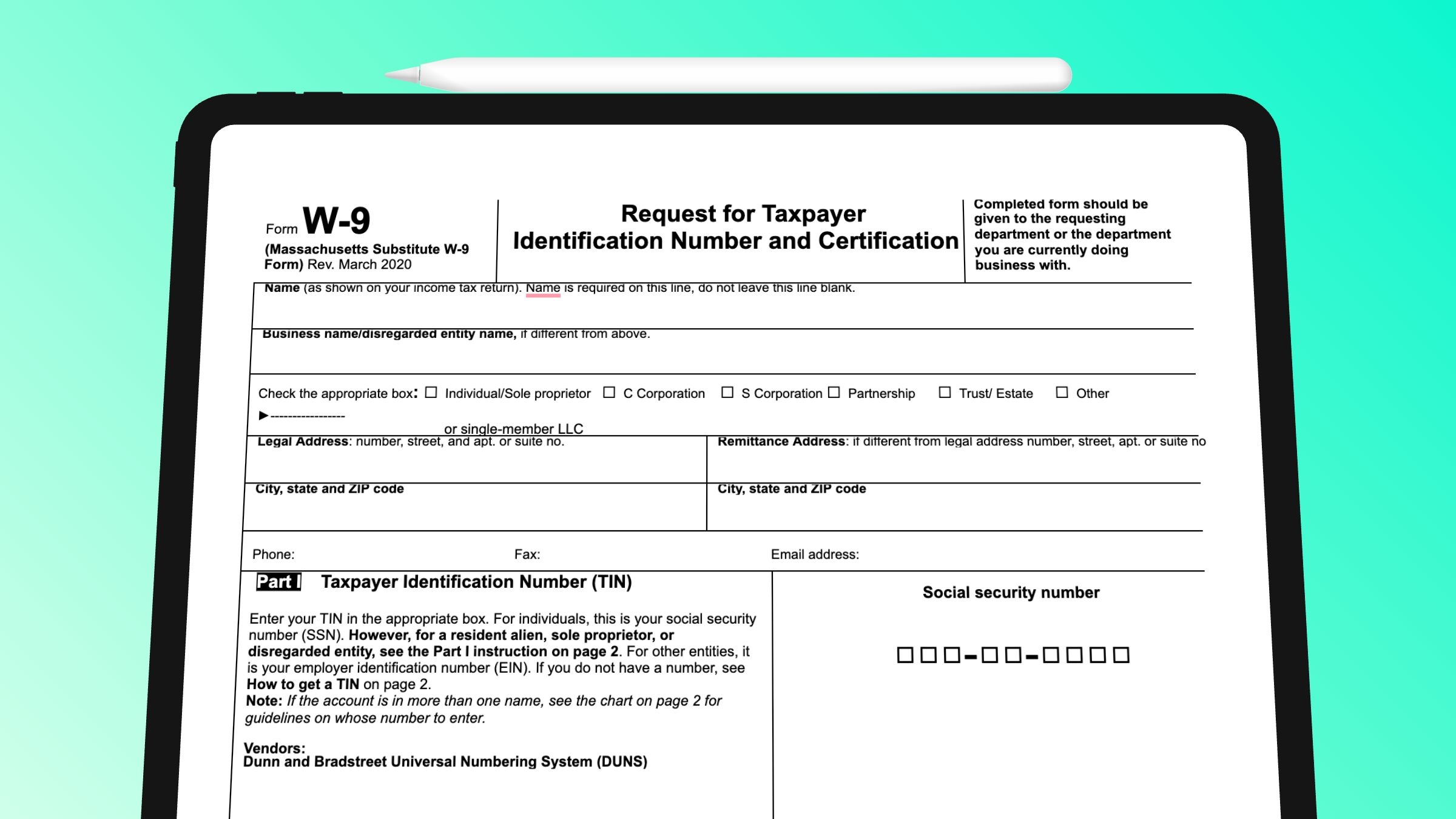

W9 Tax Form Printable

One of the conveniences of the W9 form is that it is readily available in a printable format. This means that both businesses and recipients can easily access the form online, print it out, fill it in, and submit it as needed. Having the W9 form in a printable format streamlines the process for all parties involved, making it easier to collect and submit the necessary information.

Businesses can download the W9 tax form from the IRS website or other reputable sources, such as accounting software platforms. Recipients who receive a request to fill out a W9 form can also access the form online, fill it out manually, and submit it to the requesting party. This ensures that accurate information is provided and helps to prevent any issues with tax reporting in the future.

It is important for businesses to keep copies of all W9 forms on file for at least four years, as they may be subject to IRS audits and may need to provide proof of compliance with tax regulations. By using the printable W9 form, businesses can easily maintain organized records of all vendors and contractors they work with, ensuring that they have the necessary information on hand when needed.

In conclusion, the W9 tax form is a vital document for businesses and recipients alike, serving as a means to collect and verify important tax information. With the convenience of a printable format, the W9 form makes it easy for parties to comply with IRS regulations and maintain accurate records for tax purposes.